how to avoid paying nanny tax

The burden of paying nanny taxes should never be used as an excuse for hiring a household employee under the table While legal pay is always. Nanny Household Tax and Payroll Service.

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Flexible Spending Accounts and the Child and Dependent.

. Can the IRS catch me if I havent paid nanny taxes. How to handle the nanny tax. 5 2008 123 pm ET Reporting this weeks Work Family column on how fewer parents are paying nanny taxes.

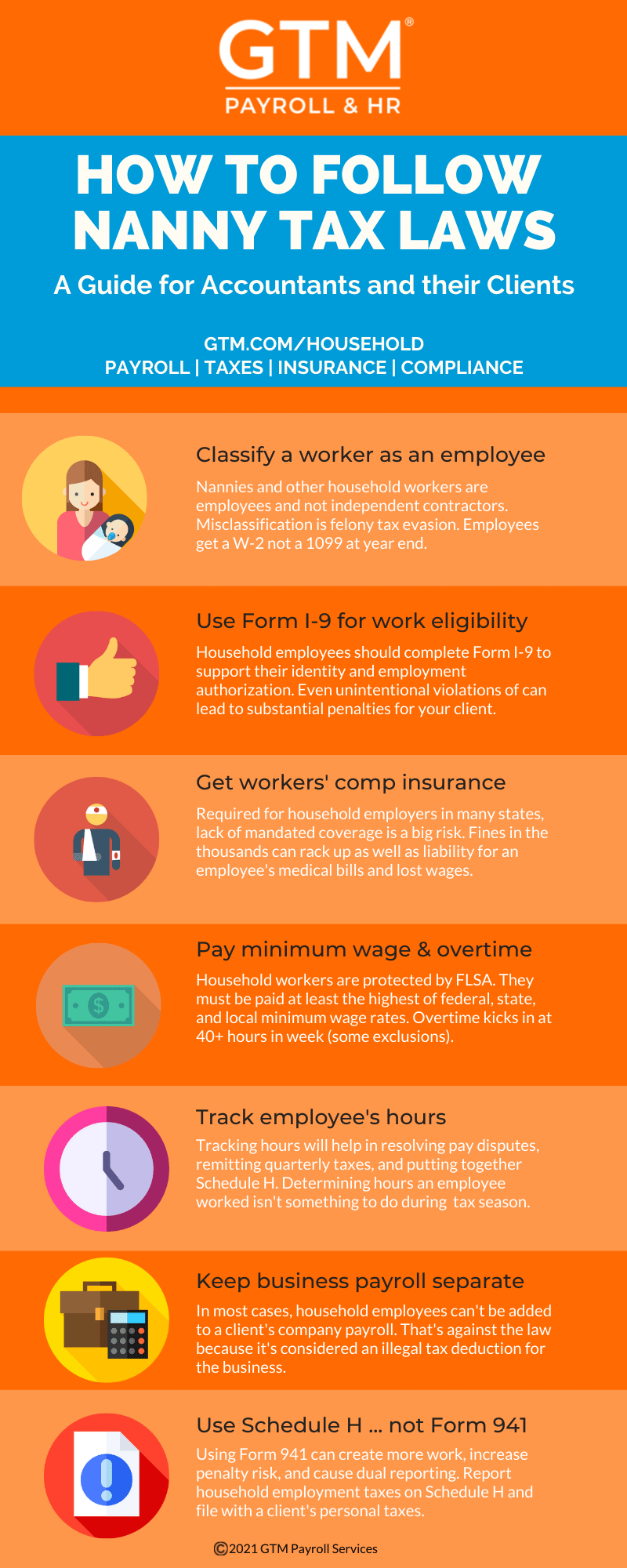

Getting caught ignoring your nanny tax obligations will come at a significant financial cost. Mandatory Tax Forms Form W-2 You must provide your household. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations.

Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. 9 hours agoAdjust Your Withholding. Once you total up the total hours dont be surprised when you.

Here are five ways to reduce your nanny taxes that can save both you and your employee money. If youre a nanny you might want to pay your nanny tax in quarterly estimated payments as the year progresses or ask your own employer to increase your withholding to. If you and your nanny agree to withhold income taxes to help your nanny avoid a large tax bill in April you can withhold a percentage of their paycheck and send it to the IRS on.

You find someone finally you can trust and you want to keep her so you pay more than average. Dependent Care Flexible Spending Account FSA A Dependent Care FSA. It builds a good relationship.

After that the IRS can expand to other income like retirement. Nanny Household Tax and Payroll Service. You can still start right now acquire assets get passive income and eventually be able to avoid paying taxes because of the next tip.

The TP can download. You and your employee each pay 765 of gross wages 62 for Social Security and 145 for. What This Means for Legal Pay.

You dont have to be audited in order to be caught by the IRS. Your kids are now in school so you dont need a full-time caregiver or. Ask your household employee for a Social Security number or an Individual Taxpayer Identification Number a completed Form I-9 and a completed federal.

In that case the nanny would need to complete a W. There are two strategies to reduce nanny taxes. What Can Happen if You Dont Pay Nanny Taxes.

Calculate social security and Medicare taxes. Take Passive Losses Acquiring. To avoid your nanny having a large tax bill at year end its a good idea to withhold income taxes.

Your first step should be to make sure enough money is being withheld from your paychecks to avoid a huge tax billand underpayment penalties at. For the first year TY 2023 the only eligible income is wages interest and dividends. Firstly calculate the gross income under all the 5 heads of income ie.

You pay her 1395 an hour. Paying or Avoiding the Nanny Tax By Sue Shellenbarger. The goal here is to avoid doing something stupid that will trigger an IRS audit ignite tabloid headlines or generate an exorbitant bill from the IRS for back taxes and penalties.

One of the biggest myths is that you can 1099 your nanny says lawyer Lisa Weinberger. If youre found not paying FICA taxes not only do you need to pay. Fined for not paying unemployment taxes.

By paying nanny taxes an employer running a business can avoid legal notice. The parents do not have to withhold income tax from their nannys pay but may choose to do so if the nanny asks them to. You can do this by filling out.

If your employee files for unemployment benefits after her. This number equals gross wages. If you issue a 1099 you are not in compliance with.

Salary house property capital gains business or profession and other sources. Employers may be eligible for money saving tax breaks by paying nanny taxes. Giving your nanny the wrong tax form.

Alternatively you can ask your own employer to withhold more federal income tax from your wages to cover the extra nanny tax you will be covering. Parents who hire a babysitter and pay nanny taxes can claim child care credit.

Accounting Firms Cpas How To Manage Nanny Taxes For Your Clients

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Hobbies That May Help Your Nanny Career Hobbies Nanny Hobbies And Interests

How To Avoid The Nanny Tax Maid Service Faqs

What Is The Nanny Tax And Am I Required To Pay It

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

Is It Ok To Pay My Nanny In Cash

Nanny Tax Do I Have To Pay It Credit Karma

What Every Nanny Needs To Know About Taxes And Payroll Nanny Nanny Tax Nanny Care

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

5 Nanny Payroll Mistakes To Avoid Carepayco

Babysitting Taxes Usa What You Need To Know

The Differences Between A Nanny And A Babysitter

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

How To Be The Best Nanny Or Sitter For A Family During Divorce Divorce Nanny Divorce Lawyers

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Pin By Aubrie Vikturek On Worth Reading Body Language Worth Reading Feelings

Horse Bill Of Sale Form Bill Of Sale Template Purchase Agreement Good Essay