tax on unrealized gains india

Now you have an unrealized capital gain of 9205. It is realized or unrealized gain or loss on exchange rate.

Koinly Blog Cryptocurrency Tax News Strategies Tips

For companies engaged in manufacturing business and opting to pay corporate tax at the lower rate interest income shall be taxable 2517 including applicable surcharge and education cess.

. India exempts NRIs from quoting Aadhaar in tax returns. So if a stock goes from 100 to 150 a piece in a year but you havent sold it. If your Income is comprised of Capital gains that come under a special tax rate you cannot save on tax outgo on the same by Investing in PPF Insurance Policies or even ELSS kind of products.

Capital gains tax in India Important rules to be aware of. Where there are unrealized gains - no tax is payable as you have not booked any profits. She wants investors to pay a tax on the increase in value of stock every year even if it is not sold.

Your internal rate is 1KHR 4000 so 200 x 4000 KHR 800000. NRIs are required to pay tax on an income of more than Rs250000 earned in India. Long Term Capital Gain LTCG Tax on redemption is exempted up to Rs.

For example if you were ahead of. Wyden and his staff have been working on the idea for two years but they havent released legislative text yet. Some of the key points are.

Short-term capital gains are taxed 15. There are only two things certain in life. Democrats want to impose a new tax on Americas wealthiest by taxing unrealized capital gains similar to other types of income a major change to how those assets have been taxed historically.

Mr P bought 200 shares of Titan Ltd. You may still have to pay a tax on that 50 a share where you havent made a profit yet. Interest income received by a foreign company is taxed at a concessional rate of withholding at 520 subject to conditions.

Senate Finance Chair Ron Wyden wants to tax billionaires unrealized wealth gains annually. At Rs 820 per share on 27 th November 2017 and sold the same 200 shares of Titan at Rs 1700 per share on 1 st July 2021. So once you sell your Mutual funds and the funds are credited to your bank account you have to compute your tax liability and pay capital gains taxes on the same.

This does not affect the application of the STT which must be paid in the usual manner. If the stock drops to 4 its market value is 400. Gains exceeding INR 100000 made on sale of listed equities of an Indian company units of an Indian equity oriented fund and units of an Indian business trust would now be subject to a 10 tax.

You have an unrealized capital loss of 10795. Non-tax saving equity funds. Short Term Capital Gains 111A Short Term Capital Gains Non 111A Long Term Capital Gains 10 Tax Long Term Capital Gains 20 Tax Lottery Winnings cash.

VAT Amount will be paid to tax admin as KHR. It is realized loss on exchange rate. For example If you have 10000 in stock you purchased in the last year and at the end of the tax year it is worth say 16000.

Besides raising capital gains tax to 40 they will annually tax unrealized capital gains. The issue of whether foreign exchange gains resulting from the translation of bank balances held in foreign currencies at year end are to be regarded as accrued and subject to tax was canvassed by the. WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital gains.

Biden said he supports the proposal as a potential method. Long term capital gain tax. 0000 0138.

The potential tax. VAT amount will be paid to tax admin 200 x 4100 KHR 820000. Gain on Larsen Toubro is Rs.

This article is in your queue. The tax on unrealized gains faces hurdles. TITAN INE280A01028 HOLDING PERIOD 3 YEARS 8 MONTHS.

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. In both cases since you did not sell the stock the IRS considers the subsequent gain or loss unrealized. Tax Breaks under section 80c to 80U is not available to Capital gain Income.

Under the ITA income tax is payable on income which is derived by a person and any income is deemed to be derived when it is earned or accrued. The capitalization under the Income tax Act is solely governed by the provisions of Section 43A of the Income tax Act 1961. If the stock goes to 6 a share its market value equals 600.

Long-term capital gains 36 months on debt funds are taxed at 20 after. They will tax you 40 of the 6000 even though you havent cash it in yet a gain on paper not realized yet. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

B Short-term capital gains. Only in case of realized gains do you have to pay taxes in case of a mutual fund. The Unrealized Exchange Gainloss arisen on account of any capital asset covered under Section 43A of the Act is not allowed to be added in case of loss or taxed in case of gain since Section 43A treats the same on REALIZATION BASIS.

Calculate gain or loss on exchange. Short term capital gain tax 55000 X15 8250. Although NRIs are exempted from income tax on their income abroad they have to.

The proposal is expected to have. WASHINGTONA new annual tax on billionaires unrealized capital gains is. If LTCG is more than 1 lakh the applicable tax is 10 without indexation.

Thats tax on unrealised capital gains.

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

Does Cryptocurrency Attract Tax In India Here S What We Know

What Is A Long Term Capital Gains Tax In India Quora

What Are Realized Gains Losses What Are Unrealized Gains Losses Quora

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

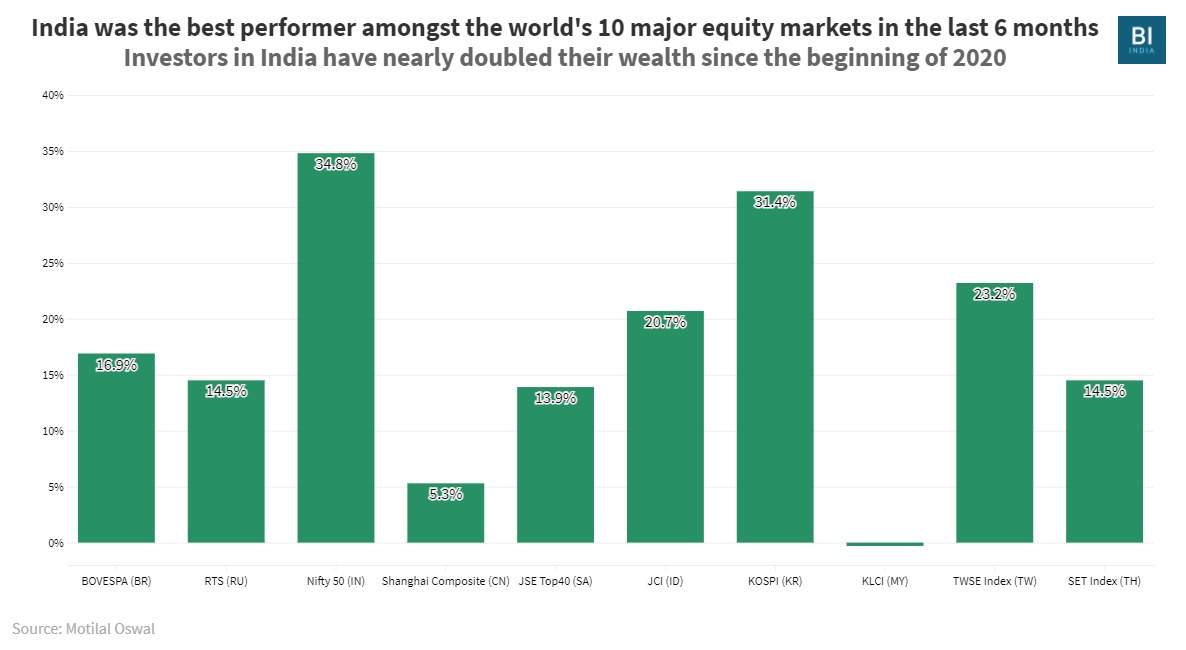

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

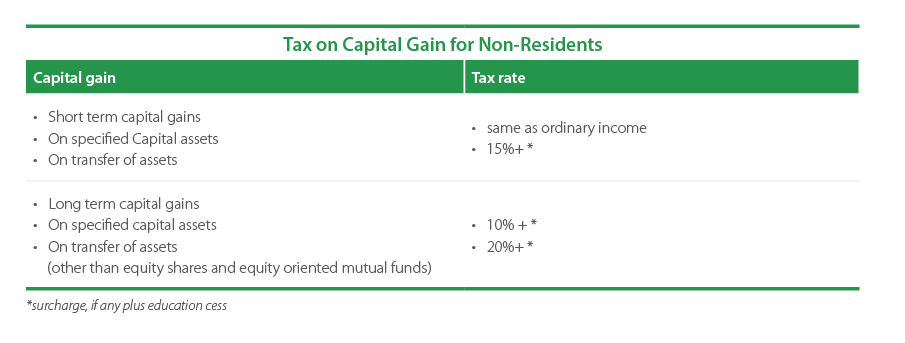

Capital Gains Tax In India An Explainer India Briefing News

Capital Gains Tax In India An Explainer India Briefing News

Explainer Income Tax Rules For Nris Who Invest In Stocks Mutual Funds In India

Save Ltcg Tax On Stocks Businesstoday

What Is Capital Gains Tax Quora

Makmn Co In Indirect Tax Financial Management Income Tax

Realized Gains On Sale Of Shares Abroad Will Be Taxed As Capital Gains In India

Capital Gains Definition 2021 Tax Rates And Examples

Save Ltcg Tax On Stocks Businesstoday

Should I Disclose Profits As Capital Gains

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Best Balanced Mutual Funds Equity Oriented Schemes Mutuals Funds Fund Equity