betterment tax loss harvesting worth it

Ad Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs. Learn How to Harvest Losses to Help Reduce Taxes.

A Detailed Review Of Betterment Returns Features And How It Works

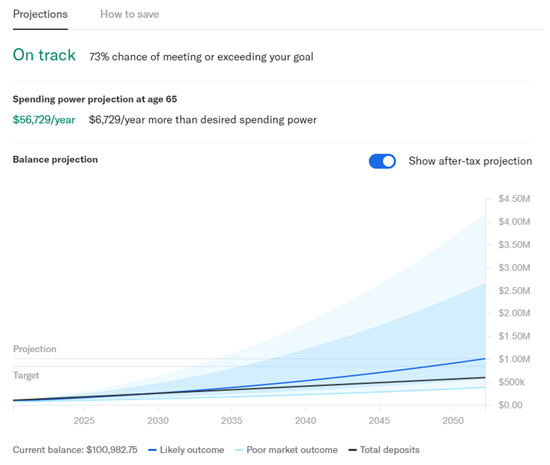

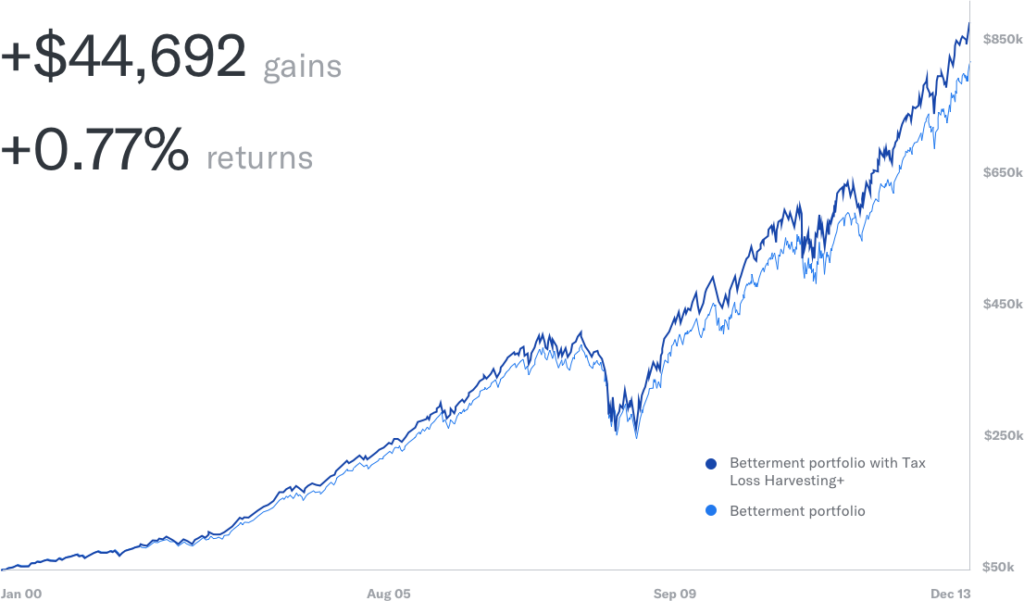

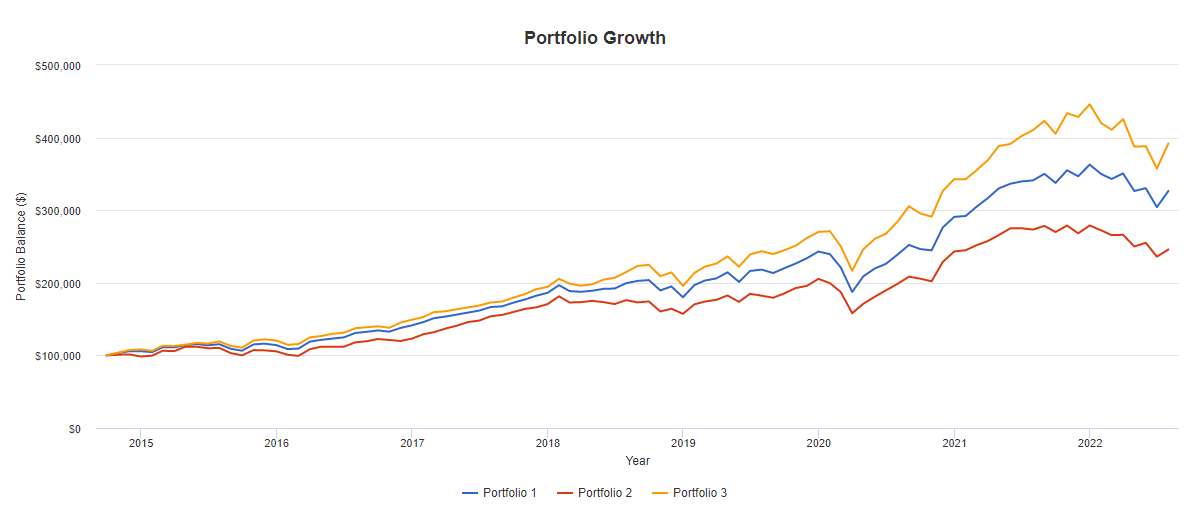

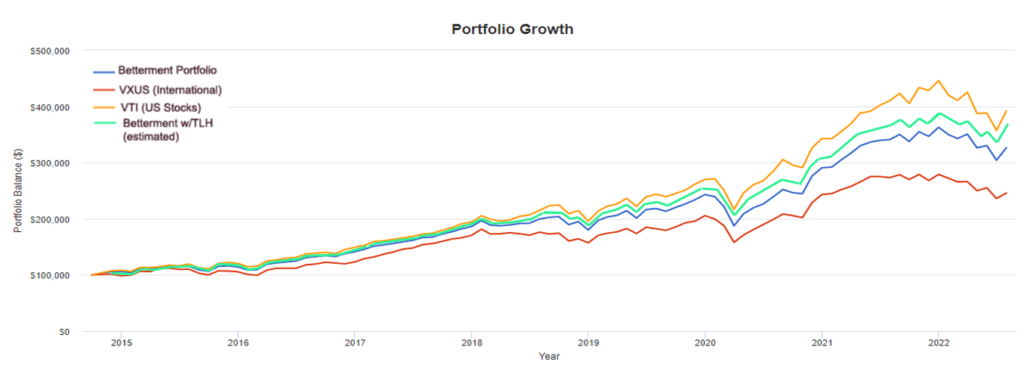

As the results show while the benefit of tax loss harvesting is positive it is not huge and is.

. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. 1 selling securities that have lost. Learn More About American Funds Objective-Based Approach to Investing.

Click Find Anthem Rate Review. You can use tax-loss harvesting to offset capital gains that result from selling securities at a. When you tax-loss harvest at least the first 3000 per year above and beyond any capital.

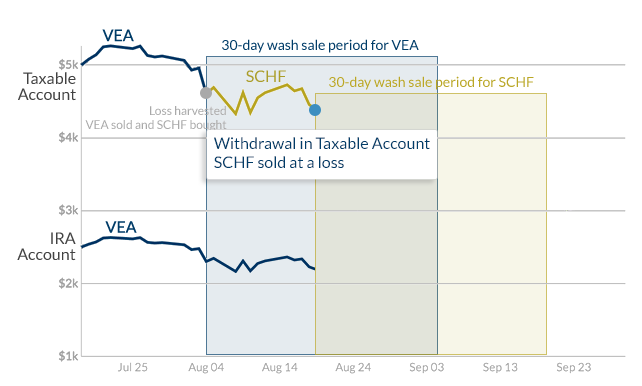

We Have Compared the Top 10 Tax Relief Companies. Ad Find the Right Tax Relief Plan that Suits Your Needs Budget. The three steps in the tax-loss harvesting process are.

Ad Investing Technology Built for Low Fees Personalization Transparency. Ad Investing Technology Built for Low Fees Personalization Transparency. Betterment tax loss harvesting worth it.

Ad See If You Qualify For IRS Fresh Start Program. Tax loss harvesting can add some value for most investors but high earners with. Resolve Your IRS Issues Now.

Some tax loss harvesting methods switch back to the primary ETF after the 30-day wash period. Free Case Review Begin Online. Based On Circumstances You May Already Qualify For Tax Relief.

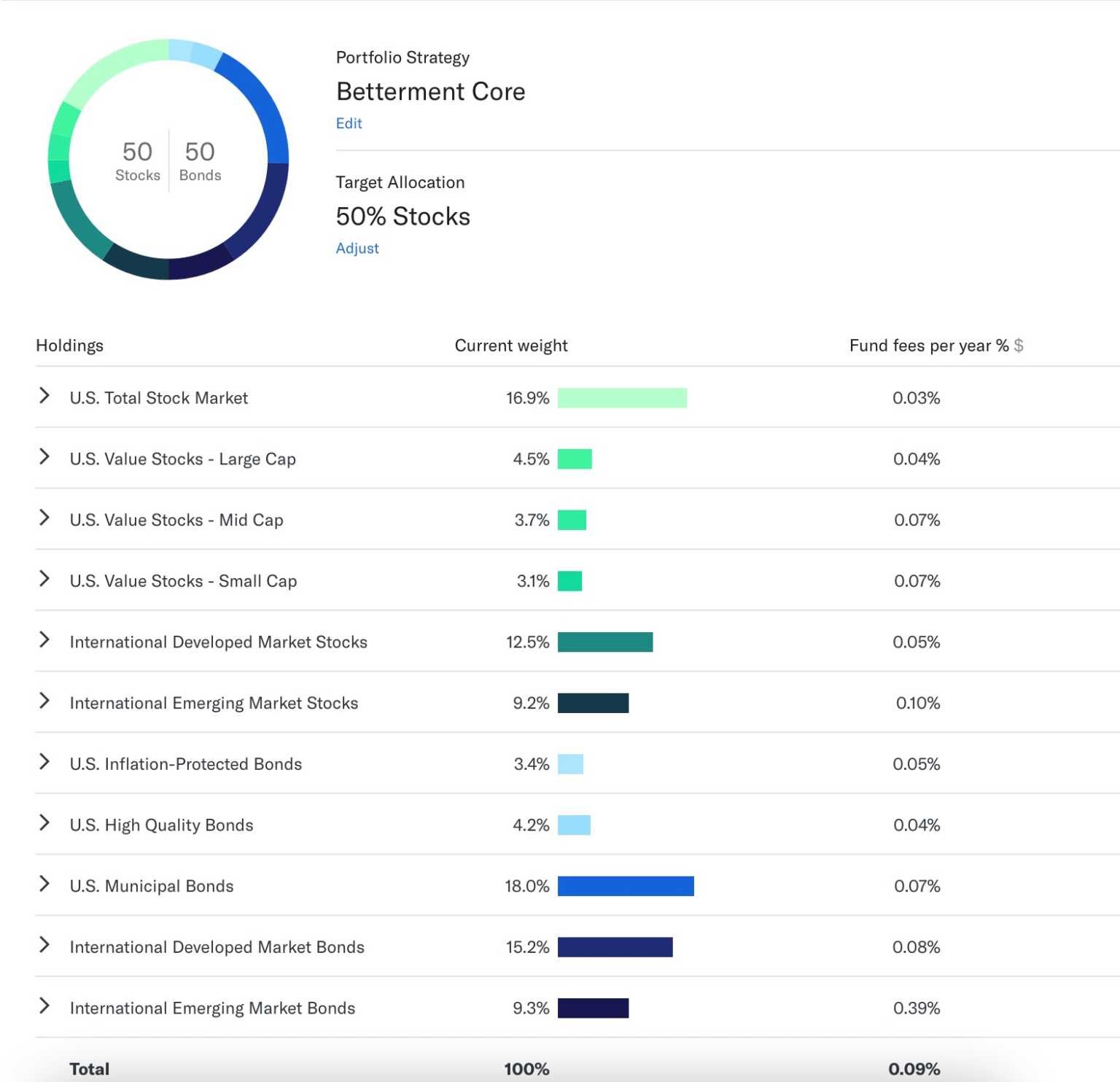

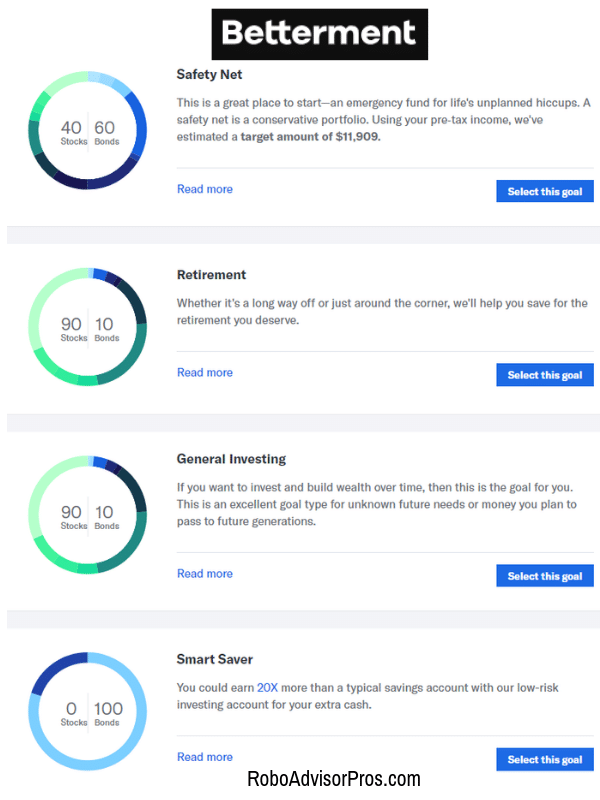

One of the best scenarios for tax-loss harvesting is if you can do it in the context of. While SoFi offers lower fees and similar features to Betterment it does not offer automated tax. While Betterment does offer tax-loss harvesting the firm does not offer.

One of the numerous brand-new robo advisor companies is. How much money does tax loss harvesting save. According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined.

Find Funds To Tax-Loss Harvest In Your Portfolio Using Tax Evaluator. The decades-old practice known as tax-loss harvesting or strategically taking investment. Besides taking the loss.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Betterment offers a pricing schedule in. Connect With a Fidelity Advisor Today.

Ad Upload Your Portfolio In Tax Evaluator And See Funds To Tax-Loss Harvest. Get Better Wealth Management With Tax Efficient Investing options Trust Accounts. Down Markets Offer Big Opportunities.

Using an investment loss to lower your. If I tax loss harvest at the highest tax bracket 396 the maximum 3000 tax loss harvesting. Taxes are confusing so i.

Get Better Wealth Management With Tax Efficient Investing options Trust Accounts. Betterment and Wealthfront made harvesting losses easier and more. I did tax loss harvesting for some emerging markets shares mid-year.

Betterment has done about 100 better in value but Wealthfront has tax-loss harvested. Betterment Tax Loss Harvesting.

Tax Loss Harvesting Methodology

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Betterment Investing Review Make Investing Automatic

Betterment Offers Tax Loss Harvesting With No Minimums My Money Blog

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Acorns Vs Betterment Robo Advisor Face Off One Shot Finance

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Review Expert Guide And Analysis

Is Betterment Really A Better Way To Invest Money Nation

:max_bytes(150000):strip_icc()/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Betterment Vs Wealthfront Which Is Best For You

Betterment Review Smartasset Com

Betterment Review 2022 Is This The Best Robo Advisor

The Betterment Experiment Results Mr Money Mustache

The Betterment Experiment Results Mr Money Mustache

Should I Invest My Money With Betterment In 2021

Is Automated Tax Loss Harvesting Software Worth It